John Morton

As the U.S. election season approaches, investors might easily become overwhelmed by the market predictions and speculations swirling around them. Predicting an election outcome is difficult enough – add in the question of “impact” on the economy, plus forecasting how that impacts your investments, and an accurate prediction seems impossible! The good news is that, despite the potential for increased volatility amid uncertainty, the historical data suggests that maintaining a steady investment course has proven to be the wiser strategy.

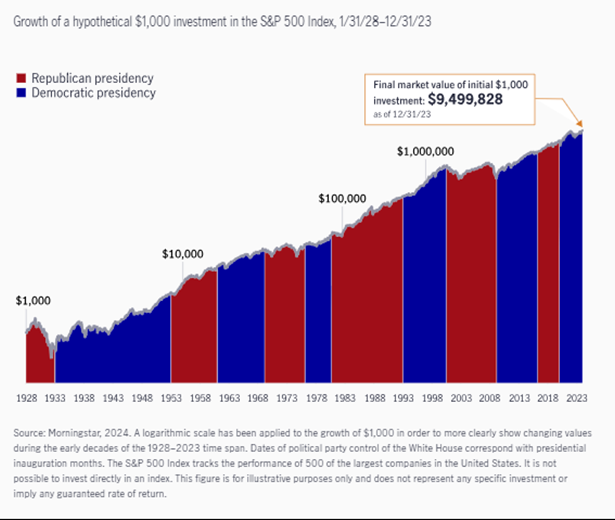

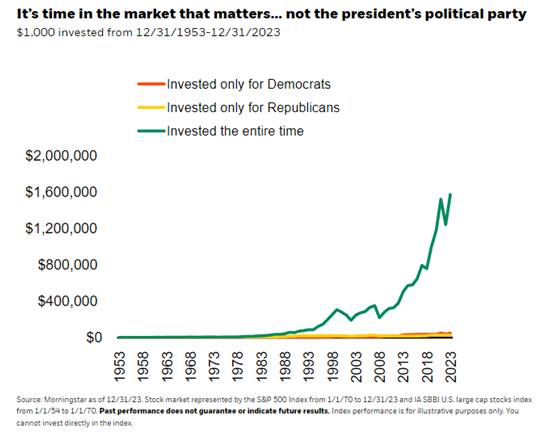

A picture is worth a thousand words, they say. If you’re focused on accumulating long-term wealth to fund your personal goals and lifestyle, then look no further than these charts when deciding between staying invested and altering your portfolio based on the political landscape and election uncertainty (or outcome!).

This chart, compiled by John Hancock, shows how the US stock market has richly rewarded long-term investors, regardless of which party has been in the White House.

And here, in a chart by BlackRock, it’s evident that investors should not enter or exit markets based on their political persuasions. Of course, the compounding result of 70 years makes alternatives to staying invested look foolish…but that’s the point.

This election cycle might seem different, given the historic rematch that America is barreling towards. And most would agree that political uncertainty with the 2024 election cycle is higher than usual. The market does not like uncertainty and, as a result, volatility will likely be high heading into the election but then die down after an outcome is determined. This is less a result of who is elected and more a function of uncertainty being resolved. The direction that markets take over the course of 2024 is likely to be dominated not by politics, but by the same forces that have historically determined how markets perform: inflation & interest rates, economic health, corporate profits, and stock market valuations.

Our advice would be to focus on first aligning your financial plan & portfolio with your values & goals, and then stay disciplined through uncertainty in both the markets and politics.