And just like that, two years have passed since spring 2020! In our daily lives and in the markets, it has been both rewarding and challenging. There has been a lot – I repeat, a lot – of things outside of our control over these two years.

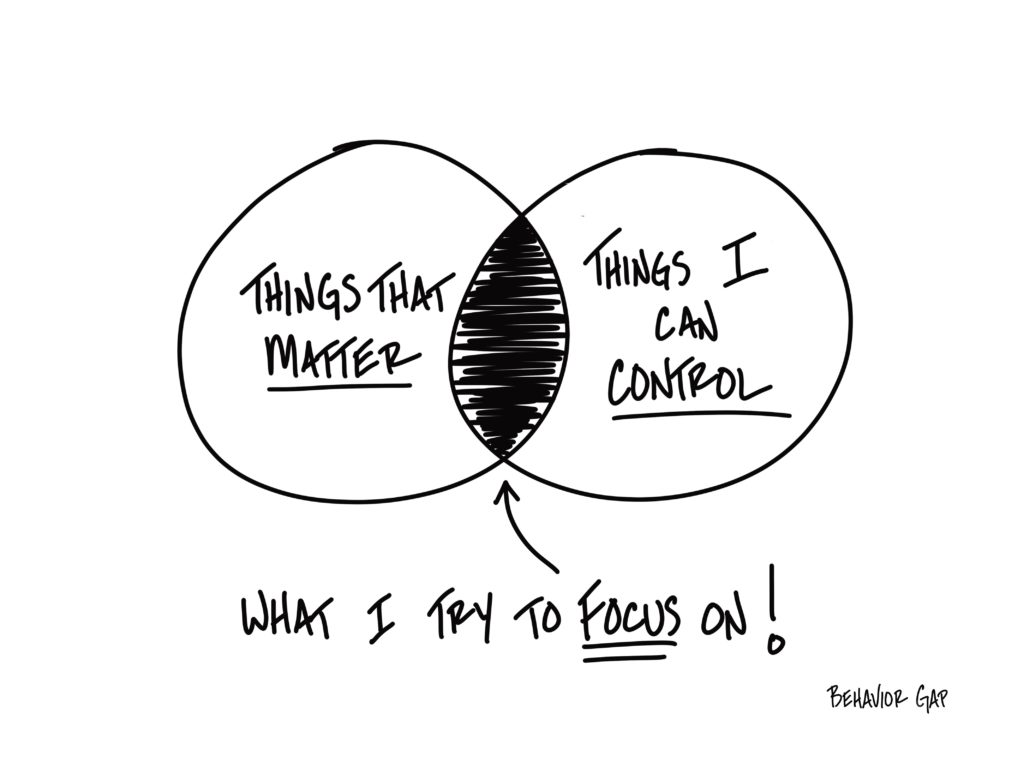

For most people, it’s hard not to let uncertain and often significant external events influence how we feel about everything else in our lives. Though often necessary over the last two years, I found the time I spent focused on things largely outside my control was frustrating and disheartening. Conversely, I think many people can relate to the inner peace and happiness we can get when we focus on things within our control, spending time doing things that we enjoy with people we love.

Similar in many ways, a focus on the right portfolio composition and personalized financial planning allows Boardwalk and our clients to enjoy the benefits of managing wealth and achieving goals even in the face of external pressures (such as blistering inflation).

Numerous polls show inflation is now the American public’s largest worry. It’s one of the biggest concerns for investors, too, which is why it’s been featured in our commentaries. The April consumer price index (CPI) change over the past 12 months has now spiked to 8.5%, up 1.2% since last month’s reading. The Federal Reserve has embarked on a rate hiking cycle to combat this, with the goal of orchestrating a ‘soft landing’ – where inflation subsides, but unemployment remains low and economic growth continues. There are some indications of the pace of inflation topping out, but there is a long way to go.

While we can’t control market returns over this uncertain period, there are aspects of portfolio management that are within our control as investors. Here are a few examples:

- Most important is determining the right asset allocation based on your individual circumstances and risk tolerance. The mix of stocks and other risky assets to bonds and less risky assets is the largest driver of both risk and return, regardless of where the market moves. We believe academically driven, globally diversified investing is key to meeting your long-term goals.

- Ongoing portfolio management such as rebalancing is also within our control. Staying exposed to out-of-favor asset classes is part of this disciplined approach, since rebalancing is in effect trimming recent winners to buy beaten down asset classes. As an example: for years, commodities dragged on performance but have been worth their weight in gold (pun intended) lately as an inflationary hedge and diversifier.

- We can also optimize tax efficiency by strategically placing assets in certain account types according to their tax characteristics, minimizing turnover in taxable accounts, and managing portfolio withdrawals.

Within the realm of financial planning, cash flow planning and revisiting long-term goals are important ways to address current concerns of inflation and market volatility.

- Cash flow planning: as costs rise for retired clients, increasing portfolio withdrawals (tax efficiently) is often necessary when inflows don’t match higher spending needs. For everyone, budgeting can also become more important as the same dollars need to be stretched. We help you think about proper cash reserves too, so that you can rest assured important goals can be met while minimizing cash on the sidelines being eaten away by inflation.

- Long-term projections: revisiting your long-term plan keeps you aware of how you’re progressing towards your goals. As things change – including higher spending needs – we adjust our projections and can model scenarios that show persistently high inflation relative to a long-run inflation assumption. There’s comfort in knowing how market volatility, higher inflation, and personal changes impact your ability to meet your long-term goals and whether any current adjustments need to be made to help align your financial picture to your vision.

With market uncertainty and inflationary concerns mounting, lean on us to provide peace of mind or a course correction to help you stay disciplined and on track to meet your goals.