John Morton

A familiar theme continued during the second quarter of 2024: US stocks led all other major asset classes, with most of this performance attributable to just a handful of technology companies. Last quarter’s commentary discussed why it continues to make sense to be diversified across global equities. This quarter, we’ll take some time to look at why US large cap stocks have performed so well recently and why, even against that backdrop, it still makes sense to diversify amongst US stocks.

This year, Nvidia hit both the $2 trillion market

capitalization (share price x shares outstanding) milestone and then in June,

four months later, it eclipsed the $3 trillion mark. For a brief moment, it was

the most valuable company in the world. This title has consistently been held

by either Apple or Microsoft over the past decade. All three companies were

worth over $3 trillion at the end of the second quarter. These companies, along

with a few others, have contributed most of the US equity market’s return this

year.

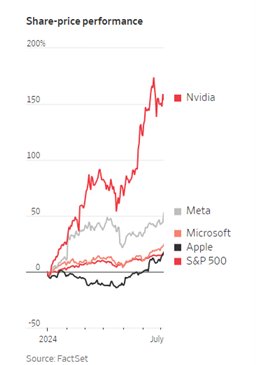

Nvidia rose 37% in the last quarter and has tripled in value

over the last 12 months. As a result, it has contributed 1/3 of the S&P

500’s year-to-date return. Microsoft, Amazon, Meta, Alphabet, Tesla, and Apple

– the other “Magnificent Seven” members – and Nvidia are responsible for about

60% of the S&P 500’s rise this year. This is abnormal, but there is

reasoning behind it. Over the last year, Nvidia, Amazon, Meta, Alphabet, and

Microsoft grew their earnings (profits) by 84%, whereas the rest of the market

increased earnings by about 5% relative to the year prior. More importantly,

these companies all exceeded the market’s expectations for earnings and

earnings growth.

Analysts will often reference a P/E ratio (“price to

earnings” ratio) to illustrate how expensive a stock is relative to that

company’s profits. According to FactSet data, the Magnificent Seven stocks are

trading at 37 times their expected earnings over the next 12 months whereas the

S&P 500 trades at 21 times forward earnings. While recent fundamentals have

supported stronger stock valuations for those companies (they have handily beat

earnings expectations over the last year) time will tell whether they will

continue to top lofty expectations.

Not only do those companies have massive revenue and profit

streams, but they are also investing heavily in generative AI technologies and

applications. You’d be right to think of it as an arms race! To get an idea of

how much money is being poured into AI, consider this: the five companies I

just listed recently accounted for 22% of all US research and

development capital expenditures. Over the coming quarters, investors will pay

close attention to how much revenue and profits those enormous investments will

generate.

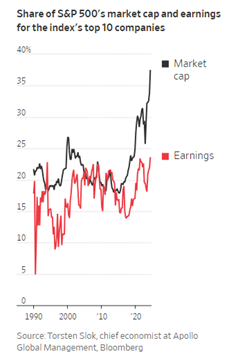

A major risk to investors in the US stock market is that as

the largest US companies increase in value, lifting the S&P 500 higher, the

index continues to become more concentrated. Right now, investors are so

optimistic about the largest US companies that they are willing to pay outsized

prices for shares of those companies (as indicated by the P/E ratios I

referenced earlier). At the end of the third quarter, Apollo Global Management

notes that the top 10 stocks in the S&P 500 make up 37% of the index while

contributing 24% of its earnings. That’s the largest gap since 1990.

Torsten Slok, Apollo’s chief economist puts it well by saying: “The problem for the S&P 500 today is not only the high concentration but also the record-high bullishness on future earnings from a small group of companies.”

If those heavyweights fail to deliver on growth and profit expectations, there will almost certainly be a stock market correction.

To “beat the index? when the largest names are only getting bigger, would require an investor to own even more than the representative portion of those stocks.

Of course, an outsized position in Nvidia doesn’t sound like a bad thing looking backward! But being less diversified only works if the right bets – at the right time – are chosen AND then properly exited before the tables turn. For long-term investors, being diversified amongst all areas of the market will produce better outcomes. It’s been a great year to be an investor in US equities – there’s no sense complaining about how it could have been better with an even more concentrated gamble on the largest tech stocks.

As we all know, diversification means that portfolios will hold both the best-performing assets and the laggards. Over time, combining assets with high expected returns but different paths toward those returns (i.e. non-perfect correlations) provides investors with a better risk-adjusted return. Said another way, diversified portfolios don’t swing as wildly – which provides investors with greater peace of mind and, for retirees, could prompt them to be more confident in their spending levels.

At Boardwalk, we have our clients’ long-term goals in mind and we work to help our clients be comfortable and confident in their financial future.