Mike Rodenbaugh

Founder

There’s no sugar coating it – the first three quarters of 2022 have seen almost all asset classes down and the fourth quarter hasn’t started off on a good note. The widely quoted S&P 500 index lost 4.9% in the third quarter and is down 23.9% so far this year. To make matters worse, bond prices have fallen as well (rather than provide stability) due to rising interest rates and credit risks. During times like these, the best—albeit difficult—advice is to try to “tune out” noise in the market and to focus on your longer-term investment horizon and financial planning optimization.

Last quarter we featured a look back in history at past recessions, noting that market downturns come in all shapes and sizes. This year’s drawn-out bear market may prove to be far more painful for investors than the sharp crash and fierce recovery of early 2020. It will also look different than the great financial crisis, the tech bubble’s bursting, or even the inflationary bouts of five decades ago.

There are a few patterns that tend to repeat themselves in bear markets:

- The market is forward looking, so there is typically NOT a clear resolution to the cause of the bear market by the time the stock market begins to recover.

- The media characterizations of the market and economic environment can still be downright scary when the market begins its recovery.

- The subsequent recovery after market declines is typically strong, although the timing and nature of the recovery varies in each case.

Here are a few strategies that can be helpful in combatting the (counterproductive) human urge to act in the face of a market like this:

- Based on the patterns above, realize that it’s very unlikely that you’ll be able to “time” the market bottom and that a “wait until things start to stabilize” likely means you’ll be late.

- If you’re a saver, try to appreciate the opportunity to invest at lower prices. Continue to save and invest to enhance the “dollar cost averaging” effect (buying more shares for the same dollar due to lower prices).

- If you’re living off your portfolio, we’ve regularly discussed cash reserves and (if possible) had you sock away enough so that you don’t have to sell stocks in a downturn. If that wasn’t possible, we can fund withdrawals from short-term bonds to allow time for stocks to recover.

- Try to mentally put your stocks “in a drawer.” We’re not planning on selling them any time soon, so try not to be overly concerned with today’s price. You don’t check the price of your home every day or every month. Why? Because you’re not planning on selling it. The same is true for stocks!

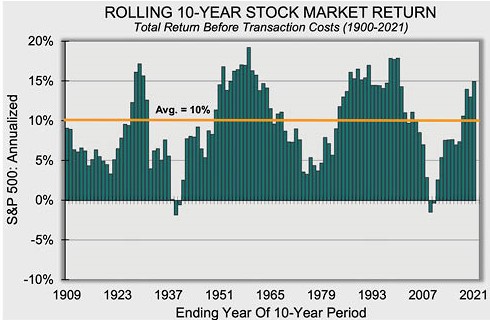

History suggests that market downturns represent a buying opportunity for the long-term. Looking at rolling 10-year returns for the S&P 500, you can see the wisdom in a long-term investing approach that avoids market timing – it’s rare to have a poor 10-year return. By combining other asset classes with US stocks, a diversified portfolio stands the best chance of meeting your long-term goals.

At Boardwalk, we have crafted your diversified portfolio with your unique long-term goals in mind, strategically balancing various asset classes and risks. This year, the team at Boardwalk has been focused on revisiting our clients’ long-term financial goals, ensuring adequate cash flow and proper cash reserves for short-term needs, and, potentially, investing excess cash. We’ve executed on rebalancing, tax loss harvesting, and, where possible, transitioned to more tax-efficient Exchange Traded Fund (ETF) versions of our recommended funds in taxable accounts.

There may be short periods like 2022 when all asset prices seem to be falling in tandem, but tuning out the noise and looking to the future is the best course of action for your portfolio (and your blood pressure). We know maintaining peace of mind during global economic instability is easier said than done and we’re here to discuss any concerns or questions you may have.