John Morton

Senior Wealth Manager

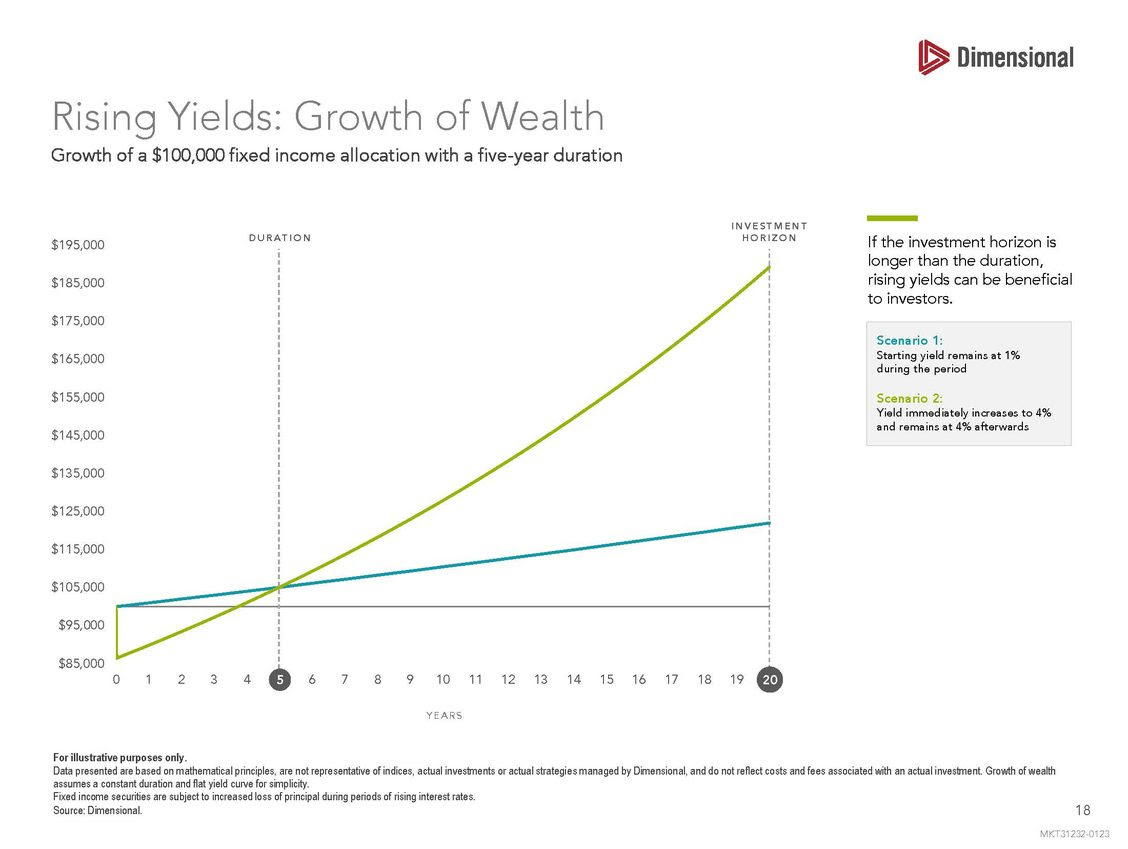

| Both stocks and bonds started off 2023 with a continuation of the strong rally that began late last year. Most would not have expected this result after recalling the headlines from this quarter, but it’s not uncommon for markets to climb a wall of worry. Since markets are forward looking, the positive longer-term outlook for assets means that investment prices tend to follow a cycle of reacting to negative news, recovering, and then climbing higher. Despite a pandemic, wars, historic inflation, and recession fears over the last three years, US stocks are still up over 18% per year during that time (as measured by the broad Russell 3000 index). At Boardwalk, we believe that better investing experiences happen by aligning individual goals and risk tolerances to a globally diversified portfolio, and then focusing on long-term financial wellbeing rather than short-term market volatility. Banking Panic of 2023 Interest rates continued to move higher in early 2023 and the Federal Reserve (Fed) indicated that it was not planning to stop raising rates until price and wage inflation showed meaningful progress toward their targets. Inflation is trending downward, but side-effects of the Fed’s rapid rate increases were put on stark display when Silicon Valley Bank dramatically collapsed on Friday, March 10. This bank and a few others had severe liquidity and risk management issues but, unfortunately, the broader financial sector has also been negatively impacted. In short: the cost of attracting and keeping customer deposits has risen, hurting profitability, and the value of the debt instruments on these companies’ books have fallen. The stress in the banking sector was promptly addressed by the U.S. Treasury, FDIC, and the Fed. They announced that uninsured depositors of failed banks would be made whole and by providing liquidity to banks via a special lending program. Importantly, these steps have quelled fears of contagion in the financial sector. For diversified investors, 2023’s banking crisis had a minimal impact on portfolios. Silicon Valley Bank represented just 0.04% of the Russell 3000 index at the end of February and the index was still up 7.18% for the quarter. As Nobel Prize laureate economist Harry Markowitz is attributed with saying: “Diversification is the only free lunch” in investing. Fixed Income Change Prior to 2022’s historic rise in rates, interest rates were very low for over a decade. It was uncertain when rates would increase, but odds were that rates were more likely to move up than further down. When interest rates rise, the value of bonds falls. For this reason, from its inception, Boardwalk had allocated 40% of fixed income investments to short-term bonds because they lose less value when rates rise. The remaining 60% of clients’ fixed income allocation was dedicated to intermediate term bonds, which earned higher yields in exchange for more risk of value fluctuation. In 2022, intermediate term bonds were down 13% (Barclays Capital US Aggregate Bond Index) while short term bonds only lost 2.8% (FTSE World Gov. Bond Index 1-3 Years, hedged). Again, this happened because when rates rose, the underlying bonds within these indices lost value. The US 10-year Treasury Note was yielding about 1.5% to end 2021 and crossed above 4% in late 2022. Similarly, the US 2-year Treasury Note paid less than 1% in 2021 and hit a high of 5.03% on March 3, 2023. With the short-term bonds having accomplished their role in dampening the impact of a rise in rates, current intermediate-term yields at much more attractive levels, and considering the now lower likelihood of further rate increases, Boardwalk has made a strategic change to clients’ fixed income allocations. We have shifted half of clients’ short-term bonds into intermediate term bonds to lock in higher interest rates for a longer period of time. Finally, to end on a bright note: while rising rates do hurt bond prices in the short-term, over a longer period, higher rates are actually beneficial for investors and result in higher long-term returns in a diversified portfolio. The graphic below compares the growth in wealth between a static low interest rate environment (1% interest rates in blue) versus the trajectory of a higher interest rate. The hypothetical investor is far better off in the long run with higher interest rates even with the jarring negative value adjustment that occurs. |

|