| When we look back at 2022, there will be plenty of material for the history books. Few, if any, predicted the size and scope of the declines and volatility seen this year. So, while it’s cliché, that is exactly why we emphasize time in the market rather than timing the market. It’s impossible to consistently move in and out of the market with good timing. Rather, investors are rewarded for taking on thoughtful risk within a diversified portfolio and sticking with that strategy despite years like this one. The Inflation Story For decades, we’ve been operating in a world with falling interest rates, low and steady inflation, globalization, and rapid technological progress. Technology and globalization have worked together to make the global economy more efficient, more stable, and more open. As such, inflation was low and stable, allowing policy makers and economies to enjoy low interest rates. The pandemic flipped everything upside down and interest rates have surged to counter the highest inflation in 40 years, as seen in the chart below from Morningstar. 2022’s ten Fed rate hikes (horizontal axis) moved the Fed funds rate higher by 4.5% (vertical axis). |

|

Higher interest rates seem to have helped dampen demand. Coupled with improving supply chains and falling food & gas prices, we’re moving in the right direction: December’s annualized inflation rate of 6.5% is a good deal below the June high of 9.1% here in the US. But it’s still a far cry from the Fed’s 2% target rate. The ongoing concern is whether the Fed’s delicate dance – raising rates enough to bring down inflation but not high enough to cause a serious recession – can be achieved. The uncertainty of inflation’s path and the economy’s resilience are reflected in asset prices, and it’s a big part of why 2022 has been difficult for investors. As we highlighted last quarter, Boardwalk is here to help our clients focus on meeting their short and long-term goals and stay invested through market turbulence. Evidenced by returns in 2021 and 2022, investors won’t ever receive the average return for a portfolio in a given year. But staying disciplined with a strategy will bring investors closer to the expected annual average return – and their goals – over time. Mean Reversion “Reversion to the mean” refers to the concept that statistical observations return to their average (mean). Take a coin toss for example – there could be a decent stretch of heads or tails (the Guinness World Record is 8 head tosses in a row). But if you flipped a coin enough times it’s extremely likely that the rate of occurrences for either side would revert towards 50%. In investing, this phenomenon is called “mean reversion” and it’s the theory that returns, prices, growth, etc. move back towards their long run average after experiencing a period above or below that trend line. It’s a powerful force. At times, there is a systemic shift in the data that would cause the long-term future trend to be meaningfully different than in the past. However, when the “this time is different” assertion arises, history tells us that it’s usually not different – it’s just that mean reversion hasn’t occurred yet. Let’s look at two examples of this in investing. Our 2021 year-end commentary featured the wide gap between valuations for the growth style of investing verses its value style counterpart. 2022 proved to be a year of significant mean reversion. Global value stocks had their largest outperformance since 2000, coming out ahead by 21%. This has certainly helped our recommended holdings, given their value tilt. The cyclicality of performance leadership between US and international stocks could point towards another area of the markets that’s ripe for mean reversion. Looking back at the last 10 years, US stocks returned 12.1% per year through the end of last year while international stocks lagged with a 4.6% annual return for US investors. That great stretch for US stocks came after the S&P 500 had a “lost decade” between 2000-2009 – it lost money while international stocks dominated. Currency returns impact international stock returns for US investors, and we’ve recently had a period with a very strong US dollar. The last time it was this strong was in the early 2000s and a weakening dollar during the rest of that decade produced a tailwind for international stock returns. Heading into 2022, valuations were also stacked in international stocks’ favor. As the dollar began to weaken in the fourth quarter of 2022, international stocks returned 16.2% compared to 7.6% for large US stocks. This doesn’t mean we should abandon US stocks all of a sudden. We think that maintaining both US and international diversification makes the best use of the global opportunity set over the long run, regardless of which area has had better performance recently. Looking Back To Look Ahead As we begin 2023, no one knows how markets will fare. Inflation and economic growth will likely persist as headlines. And while corporate earnings and households have been able to hold up against rising rates and record inflation, many expect this year to reveal the “lagged” impact of these forces. Most economists are expecting a recession within the next two years. The equity and bond markets are forward looking, however, so the current probability of these risks is factored in. Better-than-expected news could usher in strong portfolio returns even amid deteriorating conditions. Looking back at 60% stock/40% bond portfolio returns since 1926 shows that the years after a 10%+ drawdown often post strong positive performance (data compiled by Dimensional Fund Advisors). Of course, we construct our recommended 60/40 portfolios to include much more than just the S&P 500 and US Treasuries, but that’s the typical mix that Wall Street references. That 60/40 portfolio was down 14% in 2022. |

|

Patience and discipline can be in short supply when investors experience rough waters. But that’s also when future expected returns are often at their highest. Looking backward at the stellar returns exiting a market crash, investors habitually remark that they wished they maintained their stock holdings or even added cash to their portfolios when down. However, in the midst of a pandemic or global financial crisis it can be very difficult to do so. Despite the uncertainty ahead, we believe this bear market will eventually prove to be a similar opportunity for disciplined, long-term investors. We know maintaining peace of mind after a year like 2022 is easier said than done and we’re here to discuss any concerns or questions you may have. |

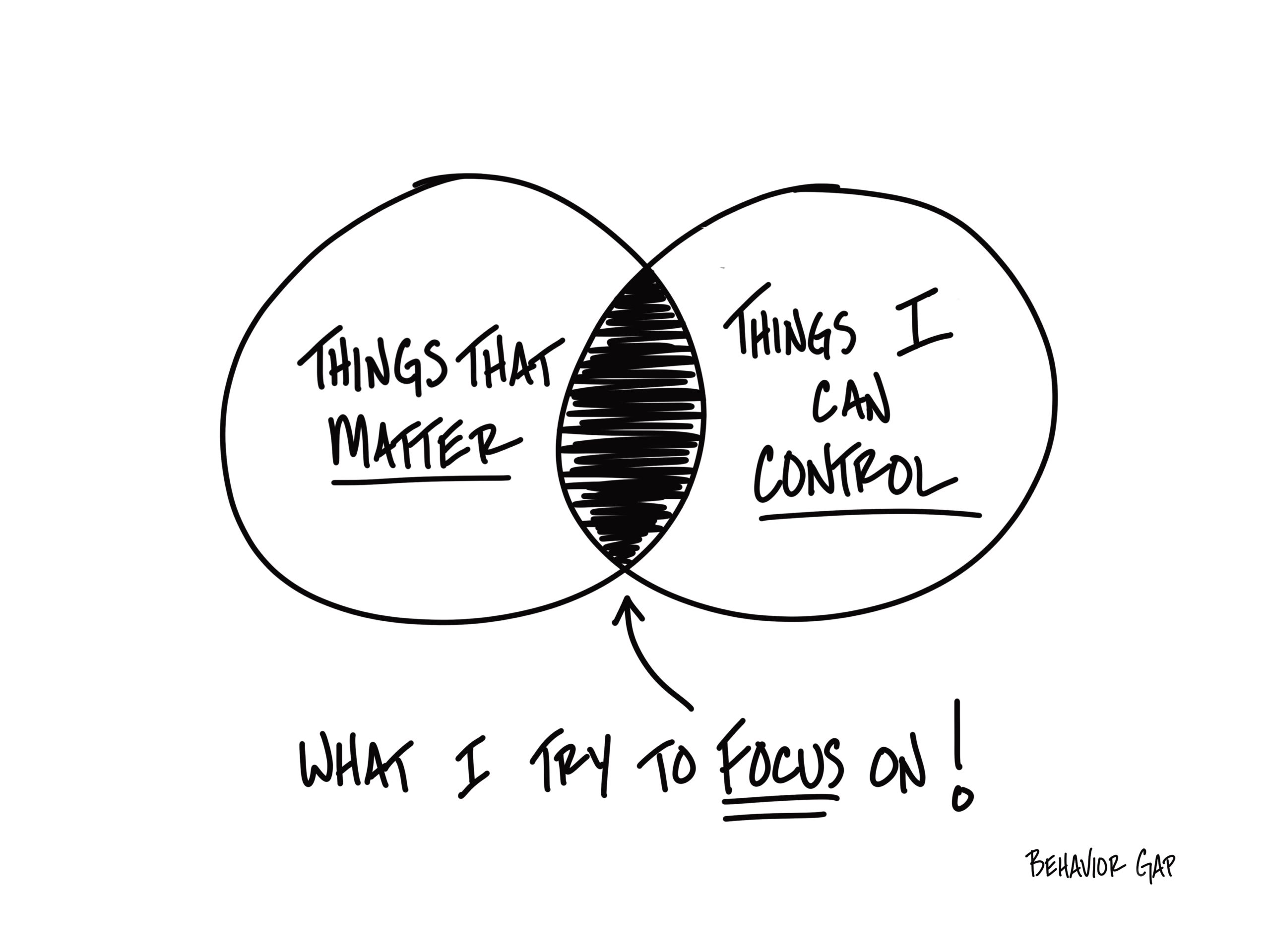

Investors’ Largest Concern and How to Manage It

And just like that, two years have passed since spring 2020! In our daily lives and in the markets, it has been both rewarding and challenging. There has been a lot – I repeat, a lot – of things outside of our control over these two years.

For most people, it’s hard not to let uncertain and often significant external events influence how we feel about everything else in our lives. Though often necessary over the last two years, I found the time I spent focused on things largely outside my control was frustrating and disheartening. Conversely, I think many people can relate to the inner peace and happiness we can get when we focus on things within our control, spending time doing things that we enjoy with people we love.

Similar in many ways, a focus on the right portfolio composition and personalized financial planning allows Boardwalk and our clients to enjoy the benefits of managing wealth and achieving goals even in the face of external pressures (such as blistering inflation).

Numerous polls show inflation is now the American public’s largest worry. It’s one of the biggest concerns for investors, too, which is why it’s been featured in our commentaries. The April consumer price index (CPI) change over the past 12 months has now spiked to 8.5%, up 1.2% since last month’s reading. The Federal Reserve has embarked on a rate hiking cycle to combat this, with the goal of orchestrating a ‘soft landing’ – where inflation subsides, but unemployment remains low and economic growth continues. There are some indications of the pace of inflation topping out, but there is a long way to go.

While we can’t control market returns over this uncertain period, there are aspects of portfolio management that are within our control as investors. Here are a few examples:

- Most important is determining the right asset allocation based on your individual circumstances and risk tolerance. The mix of stocks and other risky assets to bonds and less risky assets is the largest driver of both risk and return, regardless of where the market moves. We believe academically driven, globally diversified investing is key to meeting your long-term goals.

- Ongoing portfolio management such as rebalancing is also within our control. Staying exposed to out-of-favor asset classes is part of this disciplined approach, since rebalancing is in effect trimming recent winners to buy beaten down asset classes. As an example: for years, commodities dragged on performance but have been worth their weight in gold (pun intended) lately as an inflationary hedge and diversifier.

- We can also optimize tax efficiency by strategically placing assets in certain account types according to their tax characteristics, minimizing turnover in taxable accounts, and managing portfolio withdrawals.

Within the realm of financial planning, cash flow planning and revisiting long-term goals are important ways to address current concerns of inflation and market volatility.

- Cash flow planning: as costs rise for retired clients, increasing portfolio withdrawals (tax efficiently) is often necessary when inflows don’t match higher spending needs. For everyone, budgeting can also become more important as the same dollars need to be stretched. We help you think about proper cash reserves too, so that you can rest assured important goals can be met while minimizing cash on the sidelines being eaten away by inflation.

- Long-term projections: revisiting your long-term plan keeps you aware of how you’re progressing towards your goals. As things change – including higher spending needs – we adjust our projections and can model scenarios that show persistently high inflation relative to a long-run inflation assumption. There’s comfort in knowing how market volatility, higher inflation, and personal changes impact your ability to meet your long-term goals and whether any current adjustments need to be made to help align your financial picture to your vision.

With market uncertainty and inflationary concerns mounting, lean on us to provide peace of mind or a course correction to help you stay disciplined and on track to meet your goals.